Nigeria’s startup ecosystem is no longer the “next big thing”—it’s happening now. From fintech disruptors to agritech innovators, the country is fast becoming the Silicon Valley of Africa. But navigating this dynamic space requires more than just ambition—it calls for insight, timing, and a keen eye for opportunity.

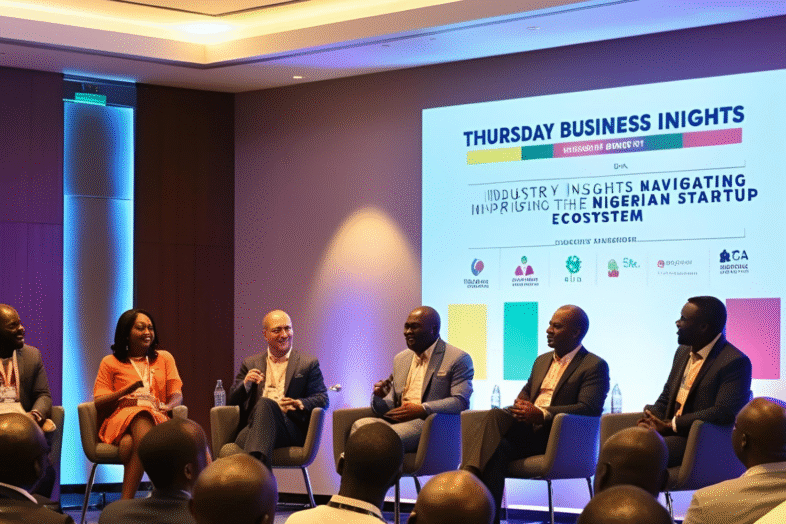

Welcome to this week’s edition of Thursday Business Insights, where we break down key developments and emerging trends shaping the Nigerian startup scene.

The Rise of the Nigerian Startup Ecosystem

Nigeria boasts over 3,300 active startups, according to recent data, making it the largest startup hub in Africa. With Lagos acting as the epicenter, supported by cities like Abuja and Port Harcourt, the growth is driven by a combination of factors:

- A youthful, tech-savvy population

- Mobile-first economy: Over 170 million mobile subscriptions

- Improving digital infrastructure

- Strong diaspora remittances and venture capital influx

Startups like Flutterwave, Paystack, and Andela have already made global headlines, attracting significant foreign investment and showcasing Nigeria’s potential as a global tech player.

Sector Spotlights: Where the Action Is

1. Fintech – The Undisputed Leader

Nigeria’s fintech sector is a powerhouse, addressing challenges around financial inclusion, payments, lending, and remittances. With over $1 billion raised in the last 5 years, fintech remains the most attractive sector for investors.

Opportunity Alert: There’s growing demand for crypto regulation, cross-border remittances, and B2B solutions for SMEs.

2. Agritech – Feeding Innovation

Agriculture employs over 35% of Nigerians. Startups are digitizing the supply chain, offering solutions from farm financing to market access.

Trending Now: Smart irrigation, mobile-based agronomy advice, and digital cooperatives.

3. Healthtech & Edtech – Growing Fast

With gaps in infrastructure, startups are filling critical needs via telemedicine, health insurance apps, and e-learning platforms. COVID-19 accelerated this transformation, and momentum has carried into 2025.

Startup to Watch: Helium Health, 54gene, and uLesson are paving the way.

Navigating the Challenges

Despite its promise, Nigeria’s startup ecosystem isn’t without hurdles:

- Regulatory Uncertainty: Frequent policy shifts in fintech and crypto

- Infrastructure Gaps: Power and broadband reliability remain issues

- Funding Disparities: Access to early-stage capital is uneven

Pro Tip: Build strong relationships with local regulators and join innovation-friendly communities like the Lagos Innovates program or CcHub for support and resources.

Investment Landscape: Where the Money Flows

VCs are bullish on Nigeria. In 2024 alone, Nigerian startups attracted 30% of all African venture funding. Global investors like Y Combinator, Tiger Global, and Sequoia Capital are consistently backing Nigerian founders.

Key Trends in 2025:

- Shift toward impact investing

- Surge in female-led startups and funding

- Rise of local angel investor networks and syndicate funds

Opportunities for Entrepreneurs & Investors

Whether you’re a local founder, diaspora investor, or international VC, the Nigerian startup space offers real opportunities:

- Untapped Markets: Solutions for rural areas, unbanked communities, or overlooked sectors (like logistics, renewable energy)

- B2B SaaS Tools: Affordable platforms for SMEs, which make up 90% of Nigerian businesses

- Talent Development: Nigeria has one of Africa’s deepest tech talent pools, ripe for outsourcing and training platforms

The Road Ahead

The Nigerian startup ecosystem is maturing fast—but it’s still early. The right idea, executed with local context and global ambition, can scale rapidly. If you’re looking to build or invest in Africa’s future, Nigeria is the place to watch—and act.

Final Takeaway

In this week’s Thursday Business Insights, we’ve seen that Nigeria’s startup scene is more than just hype—it’s a force driving innovation across Africa. With calculated risks and the right partnerships, the opportunities are massive.

Stay ahead. Stay informed. See you next Thursday.

Add Comment