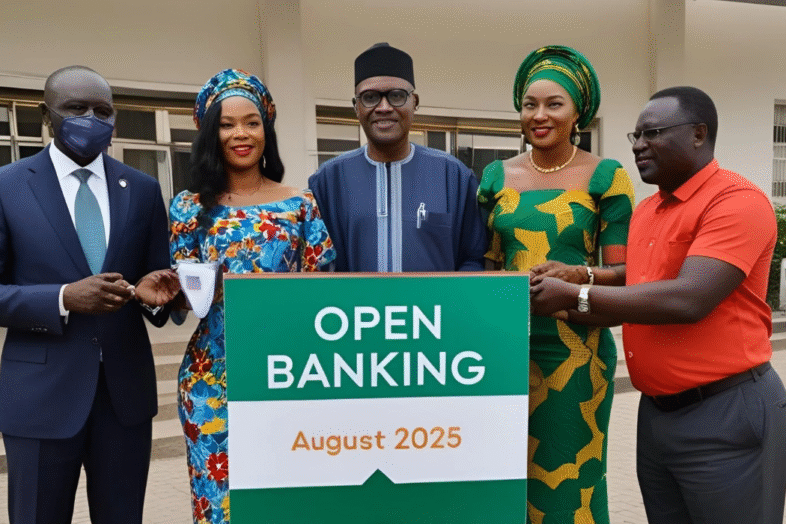

In a landmark move for Africa’s financial sector, the Central Bank of Nigeria (CBN) has approved the official launch of open banking, mandating that banks begin sharing customer data with authorized financial institutions starting in August 2025. This makes Nigeria the first African country to implement open banking, four years after the CBN first introduced its regulatory framework.

What is Open Banking & How Will It Work in Nigeria?

Open banking allows customers to securely share their financial data (such as account balances, transaction history, and spending patterns) with other regulated institutions—enabling better financial services, personalized products, and smoother transactions.

Key Features of Nigeria’s Open Banking System:

✅ Standardized API Integration – Banks and fintechs will connect via a secure, standardized system.

✅ Central Registry & BVN-Linked Consent – A central registry will authenticate all participants, while customers control data access via their Bank Verification Number (BVN).

✅ Independent Oversight Committees – Unlike initial plans to centralize control under NIBSS, the CBN has now set up independent committees led by bankers and financial institutions for fair governance.

Why Open Banking is a Game-Changer for Nigeria

1. Better Access to Credit & Loans

- Currently, 70% of Nigerian bank account holders lack access to credit due to strict lending policies.

- Fintech lenders have struggled with limited data, leading to high-risk loans and aggressive repayment tactics.

- With open banking, lenders can assess real transaction history to offer fairer, data-driven loans and help build Nigeria’s credit scoring system.

2. More Personalized Financial Services

- Banks and fintechs can now design customized savings, investment, and insurance products based on spending habits.

- SMEs and individuals can access tailored financial solutions instead of one-size-fits-all banking.

3. Boost for Fintech Innovation

- Startups can leverage banking data to create new digital financial tools, from budgeting apps to automated investment platforms.

- Increased competition will drive better services, lower costs, and financial inclusion.

Challenges & Industry Pushback

The CBN’s initial plan to place open banking under NIBSS faced resistance from banks fearing excessive control. The revised independent committee model ensures balanced oversight without CBN dominance.

What’s Next?

- August 2025: Open banking goes live in Nigeria.

- Fintech Boom: Expect a surge in new financial products and digital lending solutions.

- Consumer Benefits: More Nigerians will access credit, better rates, and smarter financial tools.

Final Thoughts

Nigeria’s open banking launch marks a historic leap toward a more inclusive, innovative, and data-driven financial ecosystem. With secure data sharing, millions of Nigerians—previously excluded from formal credit—will finally gain access to fair financial services.

Add Comment